Asset Allocation Factors that Affect Asset Allocation Tesah Capital

Why is Asset Allocation Important? The Most Important Investment Concept

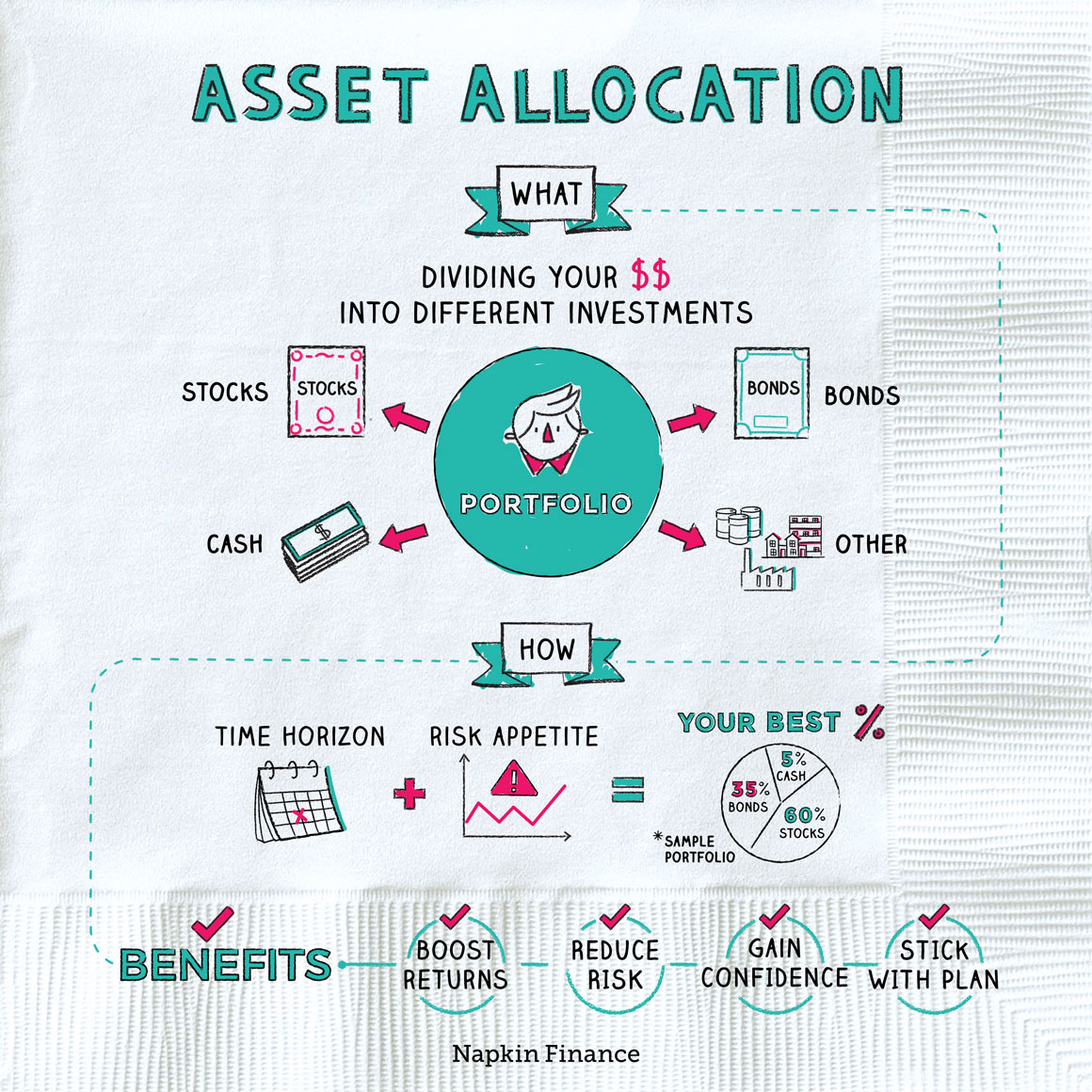

Asset allocation is the process of dividing the money in your investment portfolio among stocks, bonds and cash. When people gamble on sports, they generally bet all their money on one team. If.

5 reasons why asset allocation is important for your Financial Goals

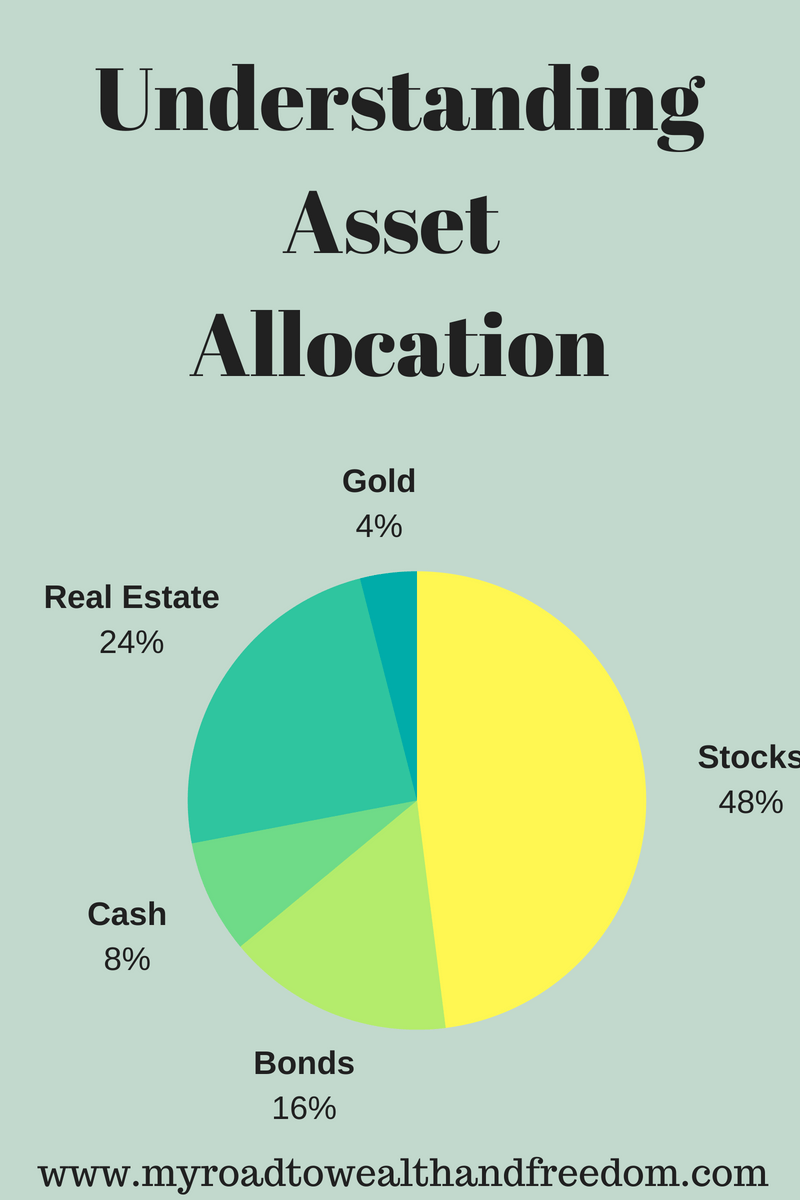

Asset allocation is the strategy that investors use to divide their investment interests among different asset classes. Asset classes are traditionally cash and cash equivalents (money market funds, which have a maturity of less than one year), fixed income securities (bonds), and equities (stocks). Some other asset classes include futures.

/GettyImages-484824862-5f1e4413297a4142915c70dd933e5432.jpg)

How to Achieve Optimal Asset Allocation Market Trading Essentials

Asset Location, Definition. Asset location refers to where you strategically keep the money you're investing — between tax-advantaged, tax-free and taxable accounts — in order to maximize.

What is Asset Allocation? Best Asset Allocation Strategies!

Asset allocation is an investment strategy that divides investments among different asset types to diversify an investor's portfolio. The investor may adjust the percentage of each investment type according to market conditions. In simple terms, asset allocation means you do not put all your eggs in one basket.

What is Asset Allocation? A Beginners' Guide Enid Kathambi

Why does this matter? Working with an advisor to find a mix of investments among the three different options is a worthwhile endeavor.. Planning for asset location should be completed after an investor's asset allocation has been determined. For instance, if a person's risk tolerance leads that person to a portfolio with a mix of 60%.

Why is asset allocation important to build wealth?

Asset Allocation Definition. Asset allocation is the process of dividing the money in your investment portfolio among stocks, bonds and cash. The goal is to align your asset allocation with your.

:max_bytes(150000):strip_icc()/assetallocation.asp-FINAL-1-c1cbc1ce1c6f4dbb8da46448bc89f64a.png)

What Is Asset Allocation and Why Is It Important?

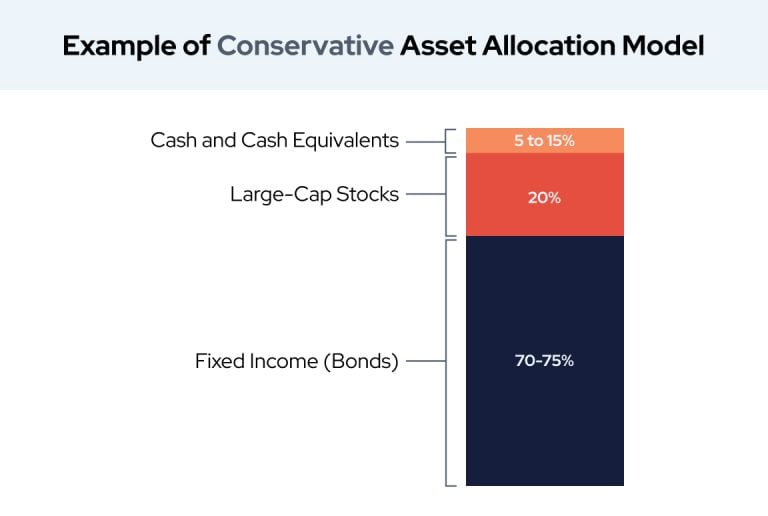

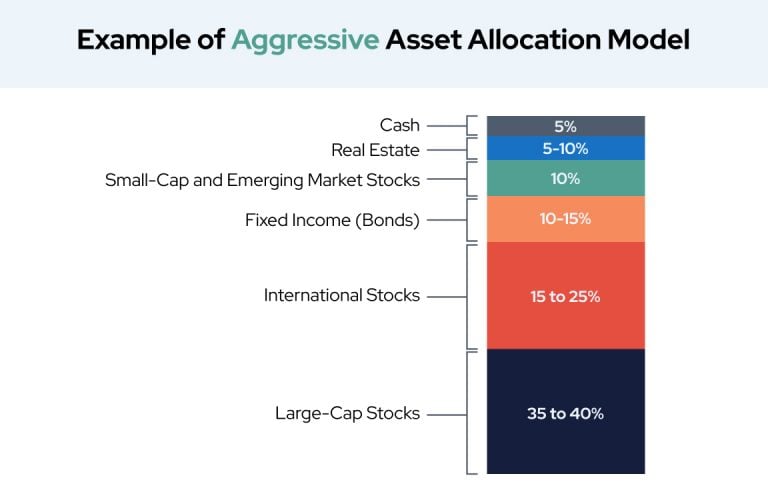

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance and investment horizon . The.

What is Asset Allocation? My Road to Wealth and Freedom

Asset allocation involves dividing your investments among different assets, such as stocks, bonds, and cash. The asset allocation decision is a personal one. The allocation that works best for you changes at different times in your life, depending on how long you have to invest and your ability to tolerate risk. Factors to consider include your:

What Are Asset Allocation Mutual Funds Overview, Benefits, Function

Asset allocation is one of those investing principles that seems so straightforward but can be harder to implement because of the various characteristics of the asset classes.

What is asset allocation and how does it work? Coastal Wealth Management

The asset allocation decision, Geczy concludes, can be an extremely complex process for investors of means. It takes constant monitoring by a team of experts ready to adjust as conditions change. Asset allocation — the mix of different investment classes in a portfolio — is the single most important factor governing returns. Wharton offers.

What is Asset Allocation & How Is It Important In Investing?

Asset location is important for a few different reasons. First, it's part of creating a diversified portfolio. Diversification is a way to manage risk by spreading your investment dollars across different assets. Asset location also plays into the diversification formula when you place money in tax-advantaged and taxable accounts strategically.

Why is Asset Allocation Very Important in Investing? investocafe

It's all about finding your just-right mix of investments (called asset allocation) that balances your tolerance for risk and potential reward for your dollars invested over time. "Asset allocation works in tandem with your comfort with risk; it helps set the foundation for the success of your investment strategy," says Heather Winston.

Beginners' Guide On What Is Asset Allocation? Importance & Strategy

Asset Allocation Defined. Strictly defined, asset allocation is exactly what is sounds like: how you allocate your assets when investing. Specifically, it is about how you allocate your assets among three major investment types: stocks, bonds and cash. Stocks are small portions of companies purchased for a price determined by the market.

Does asset allocation really matter? Scripbox

Asset allocation is the most common buzzword among investors. However, few understand the entire workings of different asset allocation strategies. For the layman, asset allocation means investing in different asset instruments such as equity, cash, debt, fixed income, real estate, etc. Asset distribution aims to reduce risks and compound the originally invested amount. How asset allocation.

Why Asset Allocation Matters More Than You Think

Why Does Asset Allocation Matter? Asset allocation is the broader form of diversification. When one asset class has a strong market demand, the other asset classes may not be delivering good returns. Investing across multiple asset classes can give you a level of protection against market fluctuations.

What is Asset Allocation & How Is It Important In Investing?

Asset allocation: An essential guide. Answers to your key questions about this important strategy for reducing risk in your investment portfolio and staying on track to meet your goals. When the markets are performing well, most people feel confident in their investing strategy. But when markets turn, it can be easy to panic.